On August 9, a day when Songshan Lake in Dongguan was boiling, Yu Chengdong, CEO of Huawei’s consumer business, released the Hongmeng operating system, which comes from Shanhaijing in Chinese and HarmonyOS in English, not the legendary OakOS.

Introducing the original intention of Hongmeng OS development, Yu Chengdong said: "With the arrival of the era of full-scene intelligence, Huawei believes that it is necessary to further improve the cross-platform capability of the operating system, including the ability to support full-scene, cross-device and platform, and the ability to deal with low-latency and high-security challenges, so the prototype of Hongmeng OS has gradually formed. Hongmeng should be born in the future."

?

The most exciting news is that Hongmeng OS is open-sourced, and the Ark compiler is also open-sourced. The entire industry will participate and develop together.

Operating systems became a hot topic after the ZTE incident last April when Android was banned. Veteran Dai Hui interviewed Academician Ni Guangnan, and the whole network took the lead in summarizing various types of operating systems in China.

In the past few years, the progress of China’s operating system has actually been quite large. The gap between server and cloud OS, embedded OS (such as communication equipment), Internet of Things and vehicle to everything OS is not large, and the PC OS has also made great progress.

Smartphone operating systems are indeed very different in terms of ecology. After discussion between Lao Dai and Academician Ni, they mentioned an idea in the article: since the APPs used in domestic mobile phones are basically domestic, then the domestic mobile phone OS + WeChat Mini Program can be used as a spare tire for Android in China.

Unfortunately! Thirteen months later, on May 15 this year, Huawei was added to the so-called "entity list", and Google’s operating system banned Huawei from supplying it. The topic of Huawei Hongmeng OS and Ark compiler suddenly became hot.

Smartphone operating systems are the commanding heights of information technology. Google strives to continue to cooperate with Huawei on Android and Fuchsia for corporate interests, but GMS authority has not been released, and Huawei’s mobile phone sales overseas will also be under pressure. How Huawei and Google will cooperate in the future will have to wait for time to tell us.

Shixing made a big deal, so he came to sort out Huawei’s OS development history. I don’t know, I was taken aback.

The origin of Huawei’s self-developed OS can be traced back to 28 years ago, and it has penetrated all three major BGs and two major BUs of Huawei’s business!

Chapter 1: Unforgettable 1991

In 1991, on the Nanshan Peninsula on the coast of the South China Sea, there was a century-defining story.

That year, Xu Wenwei (Da Xu) led the development of Huawei’s first chip – forgot to name it, just called it ASIC.

In 1991, Huawei explored entering the telecom operator market, and in the process of gaining access (developing the JK1000), it also began to develop its own operating system. Xu Wenwei was also the head of research and development.

I can’t help but ask curiously: How old are you! How old are you?! Answer: There is a "heart" (chip) and a "soul" (operating system)!

At about the same time, there was a big move in the distant northern Europe.

Finland is a place with aurora and Nokia.

In 1991, Finland made the world’s first GSM call. China’s mobile communication industry is now the strongest in the world, and there are six of the top ten mobile phone brands in China. Whether it is base stations or mobile phones, they all started to develop from GSM. This topic will not be played in this article.

That was the year that Linus Torvalds, a 21-year-old computer science student at the University of Helsinki in Finland, wrote disk drivers and file systems – the prototype for Linux’s first kernel, which ran on computers with Intel 386-series CPUs.

Linus exposed the Linux kernel through the nascent Internet (BBS) in an open-source model. Thanks to the efforts of countless people around the world, the Linux operating system has deservedly become the greatest open-source software in history.

At that time, developers around the world urgently needed a free, open, and modifiable operating system. At the time, Windows and Unix were both paid and closed-source.

Linux is born at the right time. It is not so much "man will conquer the sky" as "the times make heroes". "A spark can start a prairie fire", "dry firewood is on fire, the wind is surging", "The time is here, and it cannot be stopped", "Right time, right person".

Today, Linux operating systems are everywhere, whether embedded, PC, server or cloud, compatible with a variety of CPU forms, including Intel’s x86 architecture, ARM, MIPS, Power, Alpha (Shenwei) and so on.

Linus is known as the "Father of Linux". This title is well deserved! He famously said: Talk is cheap. Show me the code!

In the next 28 years, Huawei and Linux have had a lot of intersection.

Chapter 2: The Peacock Flies Southeast

Today, Huawei is a model for the collective struggle of more than 100,000 people. But at the beginning of entrepreneurship, there were not many people, and personal ability was very important.

After working for three years, Xu Wenwei returned to Southeast University for further study between 87 and 90 years. He was a graduate student majoring in automatic control and was taught by Professor Yi Chengbin. "One schoolbag, two bowls, classroom, dormitory, library."

Professor Yi had a great influence in Nanjing’s industry, and there were many horizontal cooperation projects. His disciple Da Xu was responsible for the specific work. On the one hand, he designed the hardware of the single-chip microcomputer, and on the other hand, he wrote the embedded software in machine language and assembly language.

Da Xu’s life is "operating system". Reading and practice are the same ("multi-tasking system, parallel computing"), there is an exceptional allowance of tens of yuan per month, three drinks and five drinks go to Lin Yan Restaurant with a beautiful boss lady on Chengxian Street ("memory management"), turn duck blood fans into burning passion and motivation ("compilation system"), cold beer invades the body’s internal organs and nine-way intestines ("input and output I/O"; "file structure"), drink too much and talk nonsense to the moon ("advanced language"), and go back to the Shatang Garden dormitory to lie down in the book ("database").

In the era of planned economy, Nanjing was the most important research and development center for automatic control and power electronics in China, and many ministries and commissions had research institutes and enterprises here. Remember that there was a subordinate automation institute that gave each person a year-end bonus of more than 10,000 yuan, which made everyone covet it! Now there are many power electronics companies represented by Nanrui, Nanzi, and Dongda Jinzhi.

Southeast University is the authentic successor of Central University’s engineering discipline in the Republic of China.

There is a movie called "West East Without Question". During the Anti-Japanese War, Central University went up the river from east to west to accompany the capital of Chongqing, Shapingba, and Chongqing University to co-locate, but it was a real "West Without Question". In 1924, before the great writer Tagore went to Tsinghua University, he first came to Nanjing and spoke in the old gymnasium that was later a ballroom. Xu Zhimo waved his sleeves and took the stage to translate: "Yu took a steamer (from Shanghai) up the Yangtze River… and the ship approached Jinling, the morning light was dim, the sound of birds was mixed with trees, and countless sailboats, sailing straight with the wind, crossing the middle stream steadily, and I felt that this kind of bright and magnificent phenomenon was about to come to the world. The proportion of human beings who have passed through a state of chaos and sacrificed their struggles."

(Picture note: Tagore took a group photo with Xu Zhimo, Lin Huiyin and others during his visit to China)

Less gossip. Da Xu’s heart already belongs, and he doesn’t spend his time in the singing and dancing. He goes to the waste electronics market of Confucius Temple when he has time. There are piles of waste circuit boards and electronic components from abroad, sold by the jin, and he can find valuable chips and devices, "treasure hunt". Use the tongue to choose a transistor. First use the two pens of the multimeter to contact the emitter and collector respectively to check the leakage current, and then use the tip of the tongue to lick the collector and base to see the change of the pointer to see the magnification.

Da Xu later wrote an instruction book "How to use a multimeter and oscilloscope to debug a programmable switch", I don’t know if I have to use my tongue?

There are also Honeywell minicomputers imported in 1980 in the computer room. They punch holes and mark "0" or "1" on paper tape to input programs and data, and the CPU can execute them directly. This is the lowest level of machine language.

A well-known foreign company, Yilida, came to Nanjing to recruit. In the early 1990s, top student Xu Wenwei and his family came to Shenzhen, a "cultural desert", lived in a farmer’s house, and developed high-speed laser printers in the high-tech department of Hong Kong company Yilida. At about the same time, Ni Guangnan also developed laser printers and chips at Lenovo.

In 1990, the ghost genius Huang Zhan wrote a song, which has been sung to this day, just to describe that era: the sea laughed, the surging tide on both sides, the ups and downs followed the waves, only remembering today. Heaven laughs, the tide in the world, who wins, God knows.

Chapter 3: In 1992, Huawei developed its first operating system

In the deep-meaning industrial building next door to Yilida, Huawei is making a small switch (commonly known as a small switchboard) for enterprise users. The bottom-level software and hardware design capabilities urgently need to be strengthened.

On the small switchboard developed by Bao (Zheng Baoyong), Huawei had its first pot of gold. However, the good times did not last long, and this field gradually became a red ocean, with hundreds of similar companies appearing in China. What China is best at is: making prices bad, and no one makes money.

Notes: Visiting the United States in 1994, starting from Liu Qiwu, Li Yinan, Yang Hanchao, Xu Wenwei, Zheng Baoyong, Li Jian, Mao Shengjiang

Post and telecommunications system using level program control switch, seven countries eight system, high profits, is the blue ocean.

Domestic manufacturers with core R & D capabilities are also trying to enter. Li Xiangting, the old leader of Lao Dai, graduated from the computer department of CITU. He said that Wu Jiangxing, a young teacher in the department, did not know how to "speak wildly:" Isn’t a program-controlled switch just a computer + a traditional switch? "Just like Li Shufu’s famous sentence:" Isn’t a car just four wheels and two rows of sofas? "

Wu Jiangxing took 3 million yuan from the Ministry of Posts and Telecommunications and started to dry, and really made a dragon! The Datang with the background of the Ministry of Posts and Telecommunications also made it, and Ni Guangnan also led Lenovo to develop it.

Shenzhen is the forefront of reform and opening up, and several are also working hard. The fastest move is ZTE. Hou Weigui is from Nanjing. He used his hometown and state-owned enterprise background to find Professor Chen Xisheng and Professor Mi Zhengkun of Nanjing University of Posts and Telecommunications. These two are leaders in China’s program-controlled switching technology. They sent three young teachers from the teaching and research department to Dameisha and developed 500 program-controlled switches for ZTE Semiconductor. The two teachers went back because their families were in Nanjing, and the bachelor Yin Yimin stayed. Changhong’s technology originated from Changchun University of Posts and Telecommunications (now merged into Jilin University). Sunda, a subsidiary of the central enterprise China Electronics, is also famous for a while.

Today’s Huawei is very powerful, but at that time Huawei was just a "grass-roots team". The developers that Ren Zhengfei, who has worked in construction and raised pigs, can find are not graduates of the program-controlled exchange system, most of them are graduates who have not yet emerged from the fledgling, and the smell of students has not yet dissipated! Guo Ping poached Zheng Bao to use Huawei, Bao took everyone to fight a few times with the little gangsters on the street, and he was born in rural Fujian and has thick arms.

As far as Dai knew, the first communication graduate to join was Wang Cheng from Beiyou. The boss took a look at his resume: What? Beiyou, I want it! So Wang Cheng went to his classmates and alumni with a satchel on his back to help. Later, he served as the president of the domestic marketing department, and Dai was his sales soldier.

To enter the post office system, you must first have a production license issued by the state. When Huawei wanted to do it, there was no indicator for 500 doors, and only 1,000 doors still had a chance. Time is still tight, and there will be no such store after this village.

In order to prevent a rush of vicious competition, domestic licenses are often used to restrict. For example, in 1998, Huawei issued GSM and CDMA mobile phone licenses, but because of the pain in its heart, it did not get them, which made it impossible to enter the mobile phone industry for many years. Later satellite set-top boxes and payment licenses are all the same story.

In the winter of 1991, Huawei established a project team with only a small number of personnel (about 10 people) to try to make equipment for operators, and since then it has embarked on the road of no return to dance with the "wolves" of the world. This is a tragic process of "unsuccessful, benevolent".

The title track of Matthew Lane’s melancholy album "Wolf" in the Yukon, Canada, echoes this scene: You would be a sweet surrender, I must go the other way, and my train will carry me onward. Please let go gently, I must go far away, my train will take me to the end of the world.

Time was very tight. If he could not close the gate at the end of 1992, there would be no "tickets" to enter the post and telecommunications system, and there would be no Huawei today. Boss Ren might really go to "raise pigs", maybe he could make a "Ren Woxing native pig".

Whether the switching network is air separation or digital has no impact on passing the appraisal of the Ministry of Posts and Telecommunications. It is difficult to achieve analog air separation technology above 500 doors, so Da Xu organized and developed two 500-door analog air separation modules together to make 1000 doors.

Some articles on the Internet believed that the JK1000’s failure to use digital panels was a mistake, and they spread falsehoods. This view was wrong. Back in 1991-92, Huawei did not have a few guns, and the telecommunications door did not step in. The primary goal was to grab "tickets", and the key needs to be solved were naturally.

To enter the post and telecommunications system, the core is to achieve "program control" at the telecom operator level, that is, the host system, which can effectively manage, bill, and promote new services. With extremely limited manpower and material resources, what technical path can the core host system adopt to achieve the goal the fastest? There were 4 options at that time.

1. Huawei’s previous HJD48 user computer was based on the control method of single-chip microcomputer and assembly. Although it was also touted as "program control" externally, it was mainly for making phone calls. However, the Ministry of Posts and Telecommunications has many requirements for network access, and assembly language cannot be used on traditional single-chip microcomputers.

2. CPU chips that use RISC (Reduced Instruction), such as the Motorola chips that were popular at the time. It is difficult to write software in high-level languages (such as C), and it is also difficult to write operating systems and promote new businesses.

3. Using the 386-based PC main board available on the market (the most familiar to the enthusiasts), it cannot meet the reliability requirements of the Ministry of Posts and Telecommunications, and various interfaces do not match, and there is no way to do hot backup.

4. Self-designed high-reliability motherboard based on 386 chip (without the general-purpose PC main board on the market), supports hot backup, self-developed BIOS, and uses high-level language (C language) + assembly mixed programming to write host software.

JK1000 finally decided to adopt mode 4. This newly developed main control board is also named MPU (Main Processing Unit).

Da Xu is a hardware developer and assembly expert, Nie Jianlin is a C language expert, combining two swords, and forging the host software system of JK1000 with everyone. Adopting a mixed programming method of C language + assembly.

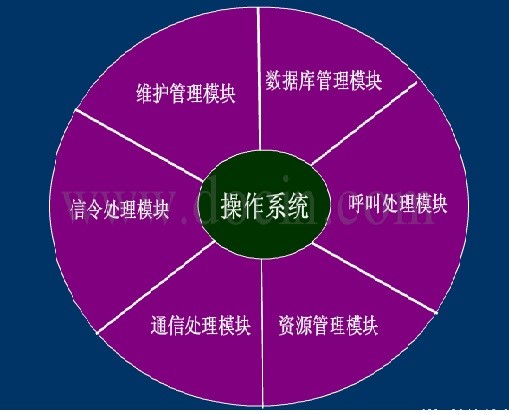

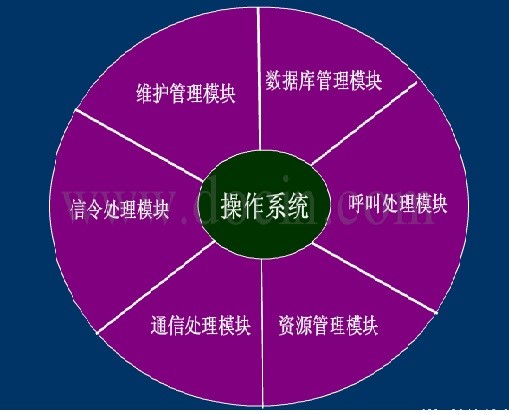

Note: The host software structure of C & C08 is the operating system

Figure Note: Functions of each part of the C & C08 host software

The core of the JK1000 host software system is an original embedded operating system based on the command line, which is developed from the beginning. It initially has the basic characteristics of the operating system, such as the management and allocation of all software and hardware resources, task scheduling, control, and coordination of concurrent activities.

Software testing is a difficult problem. At first, the host software system was hung up at every turn (stopped running or caught in an infinite loop). In order to check where the problem was, a lot of effort was spent on designing a lot of counters in the program and storing them in a specific location in the memory. After the crash, by checking the value of the counter, we can analyze and determine where the problem is. Has anyone gone directly to the memory to change the health point when playing the game?

It is said that Ren Zhengfei often comes at 9 o’clock in the evening to deliver bread and milk to everyone, and brags to everyone that "I will be drying money on the balcony in the future", a very good "political commissar" and "instructor".

More than a dozen amateurs, in just a few months, in the second half of 1992, they developed the JK1000 (post and telecommunications) bureau program-controlled switch. Huawei really had no money at that time, and Ren Zhengfei himself just rented a small house to live in.

This is also the first time that Da Xu has led a team to fight, completing the big "turn" from working hard to looking up at the road.

In the second half of 1992, a town in Haining, Zhejiang opened the JK1000 switch for the bureau. Da Xu, Nie Jianlin and R & D colleagues were on site to modify the software, compile, load and run, which was the local method of the year.

The director of Zhejiang Haining Bureau is very nice. Every fifteenth day of the lunar calendar, he pulls all Huawei’s people out to watch the Qiantang tide. Everyone is excited and has a lot of thoughts.

In this way, the JK1000 Bureau used the program-controlled switch at the last minute, passed the appraisal of the Ministry of Posts and Telecommunications, got the network access certificate, and could sell it! It can be said that this is a "golden key". God bless Huawei, and from then on Huawei began its journey of opening up.

Let’s take a moment to celebrate the birth of C at Bell Labs. C is a great high-level language that greatly reduces the pain of programmers writing assembly, and can also create a large number of software functional modules and make flexible calls.

Write the software in C language, generate the assembly code through the C language compiler, and then convert it into binary executable code through the assembler. Programmers need to understand the assembly code and the connection between it and its source C code, because the compiler hides too many details such as program counters, registers (integers, conditional codes, floating points), etc. This is the strength of Da Xu.

Here lies the foreshadowing of the compiler. Today, Huawei already has the Ark compiler, which can run faster on mobile phones. On August 9, Huawei announced that Ark was open-sourced to the outside world, benefiting the entire industry.

Lao Dai’s C language was enlightened by Tsinghua student Lu Li, who later also went to Yilida and is now the king of China’s mini walkie-talkies.

The host system of the JK1000 became slower and slower to use (the same was true of the early Android). Daxu was set at 2 o’clock in the middle of the night every day. When no one called, the system automatically restarted, released all resources, and started all over again.

After a successful start, the stress was released, and Da Xu was admitted to the hospital. Only then did he have time to quietly read books on the principles of communication, and he sighed with emotion: It turns out that communication is such a thing, and he has been developing it as an automatic control device! Huawei’s style is "get married first, fall in love later, and grow up in a hail of bullets".

Huawei sold the JK1000 with great fanfare at post and telecommunications offices across the country. At that time, Western companies were very good and expensive. There are more than 2,000 counties in the country, and the post and telecommunications offices in each county have decision-making power.

Going deep into the front line and encircling the city from the countryside was Huawei’s development path. It opened offices in major provincial capitals and initially established a market system covering the whole country, but it was also very simple. Yao Fuhai went to Taiyuan, Shanxi Province, found a hotel to stay in, and called to tell the company which hotel and which room he was staying in. Taiyuan Office was established like this!

Shenzhen enterprises have a variety of sales methods, and 10,000 words are omitted here.

JK1000 has sold nearly 200 units in more than a year, making a lot of fast money.

Many articles on the Internet said that because the JK1000 was an air separation system, Huawei had to start the development of the digital standard C & C08 at the same time, which almost caused the company to collapse, and Ren Zhengfei almost "jumped off the building".

The reality is just the opposite. Without the JK1000 card getting the "admission ticket" at the time point, Huawei would not be able to enter the door of telecom operators. Without the nearly 200 sets sold by JK1000, Huawei would not be able to afford the cost of developing digital machines. More importantly, it would not have the confidence to really do telecommunications work.

If the level is not good, the service will come together. Yu Weihua, the president of the "Huayou Association", joined Huawei in 1994 and started to go to Northeast China to do service. Montenegro, which had a famous defense battle, had a JK1000 in a township that was smoked due to lightning strikes, but the staff was stunned by their heroic rescue. He rushed to the scene and found it difficult to repair. Director Su Wei instructed: Don’t leave "criminal evidence", send a new machine immediately! Immediately find a trolley and pull it all away, "dig a hole and bury it deep"! The new machine will arrive on the back foot. Lightning protection and flame retardancy are process problems that have nothing to do with communication technology, and the lightning protection and grounding of the township computer room back then were really bad. Huawei used its quick response to go deep into the white water of Montenegro to gain a foothold and customer understanding. Lightning protection is a common problem, and it took Huawei years to finally resolve it with difficulty.

Chapter 4: Moderate innovation, steady progress, step by step

When the success of the JK1000 development was in sight, Huawei started the development of the digital computer C & C08A. The host system fully undertook the technical route of the JK1000, and the hardware focused on solving the technical problems of the digital grid board. As the person in charge of the device room, Da Xu was also at the forefront.

In 1993, after the successful development of the A-type machine, the development of the Wanmen machine continued (the C-type machine and the subsequent B-type machine). The main technical problems solved this time were two, one was to improve the integration and capacity of the digital network board by designing the chip yourself, and the other was to realize the connection between multiple modules through optical modules.

It can be seen that Huawei’s successful experience is to control the innovation workload of each product development within a certain proportion to ensure that each product can be sold commercially. Step by step, make steady progress, and advance layer by layer, rather than expecting to become a fat man in one bite.

Later, Ren Zhengfei said in his speech on "Entrepreneurship and innovation must be centered on improving the core competitiveness of enterprises": "We propose that in the development of new products, we should try to use the mature technologies that the company already has, as well as technologies that can be purchased from the society. If the utilization rate is lower than 70% and the new development volume is higher than 30%, it is not only not called innovation, but waste. It will only increase the development cost and increase the instability of the product."

People are getting old, and recent events may not be remembered, but the dusty past comes to mind from time to time.

In the early years, the host software was a big package, and every time it was upgraded as a whole, it was reset and restarted. Unlike Western companies, which could fix bugs by patching. In order to solve online problems, sometimes several versions would be released in one afternoon, such as the three o’clock version, the five o’clock version, and the seven o’clock version.

In order to achieve a fast reset and restart of the entire system, Daxu used FLASH flash memory technology, first LOAD the new version of the host software on the flash memory of the backup MPU, restart the MPU, and then switch the main and standby MPU, and the entire system was successfully reset in one second, which can be called "the speed of light"! This technology was often touted by Lao Dai when he sold mobile GSM later.

Lao Dai has a classmate surnamed Zou. He graduated from ZTE Communication in 1997 to develop a program-controlled switch kernel. ZTE launched a stock attack before going public. 1997-11-11 Singles Day ZTE went public, he made a lot of fast money with lightning speed. To celebrate his fortune, Lao Dai also went to Liantang for a lively time and heard him mutter: Memory management is the most troublesome technical problem of the program-controlled switch host system.

Wang Yingjun, who joined Huawei in 1997 with Lao Dai, rented a farmer’s house in Yuehaimen Village together. Later, he became one of the giants of Huawei’s core network. In 1998, everyone was exchanging small movies in Hong Kong with great interest while talking about technology. He read all the host software code. It was written in C language, and the core was an operating system based on the command line like DOS. He said that the most terrifying thing was that there were a bunch of global variables, which was extremely painful to track. As a core tester, he once went to PK with ZTE Communication and modified the internal parameters overnight to compile overnight, so that the CPU occupancy rate under the same load was lower. CPU occupancy is a core indicator. The CPU occupancy rate of Lao Dai’s typing computer is now 77%.

Wang Yingjun studied chemistry, but he wasn’t interested in this major at all, so he took the exam as a senior programmer and fell into the pit of "01010101". We grew vegetables together in Xili’s farm a few years ago, and he never talked to me about Hong Kong movies anymore. He talked about poetry and the future. Being a leader is different.

Zeng Haowen, a disciple of Professor Mi Zhengkun of Nanjing University of Posts and Telecommunications, is Yin Yimin’s junior brother. After graduating in 1997, he came to Huawei and started as a development engineer. At the turn of the century, he became the research and development leader of the 128 module of the last version of the C & C08. Claiming to be able to support millions of users, Huawei achieved the world’s first sales volume in narrow-band digital program-controlled switching for the first time. Zeng Haowen remembered a saying at that time: Huawei did not want to become the world’s first, but had to walk on the road to becoming the first.

Interestingly, after the first version of the 128 module was launched, many bugs were found, and it was very troublesome to modify, so the entire system code was rewritten. The same thing has been done by GSM.

Is there anything wrong with Windows?

The core front-end host software (including the operating system) is indeed never Windows, but there is also a BAM module (background management unit) on C & C08 that can be used. Even if the BAM module is turned off, the front-end host software of C & C08 still runs. BAM later evolved into OMC, and Zheng Yelai, the head of Huawei Cloud BU, was the head of OMC development at that time. The first-line OMC application software occasionally has a little flaw, and the veteran Dai Hui gave feedback, and the OMC interface person answered ironically: It is the compatibility problem of your foreign Windows versions, and it has nothing to do with us!

Finally, let’s talk about the business model of software sales, which is closely related to the host software.

In the early years, there was no license control in the host system software, and upgrades and software services were also free. As long as customers continue to buy Huawei equipment, anything is negotiable.

In 2004, I went to the Indonesian operator and found that Siemens’ service staff came over once a month to see how many users had grown online. They would issue an invoice to the operator and collect a handful of money. However, Siemens did not do anything. How could they receive money?

The strategy and MKT business model department established by Xu Zhijun (Xiao Xu) has a business model department. It studies industry practices and begins to engage in "stock charges", license control by user and function, and annual software maintenance and upgrades together also charge an annual software service fee. Huawei’s technical support department has reaped huge profits as a result. Zeng Xiangsen and Wang Haijun successively served as the head of this department.

Back then, it was mainly by selling hardware to make money. I didn’t expect that today, software licenses are the real money. Because after the core network is all clouded, the underlying hardware is a general-purpose server, and anyone can sell it, and the gross profit becomes as thin as a piece of paper.

Chapter 5: The OS of the Core Network Becomes the Foundation for the Development of the Whole Huawei

In the recent Sino-US trade friction, everyone has noticed the term "5G core network". The United States has paid a lot of attention to the core network, which shows that this is a very important network equipment.

From a functional perspective, the core network not only serves landlines (fixed phones), but also mobile phones, including 2G/3G/4G/5G, etc. When a specific service is 5G, it is called the 5G core network.

The core network has undergone tremendous changes in hardware and operating systems over the years.

The real-time operating system of Huawei’s core network has undergone four technological changes.

28 years ago, Daxu and the others developed their own operating system bit by bit from the bottom up.

The small companies in the West that make RTOS (real-time operating system) kernels have only started with two or three people since the 1980s, and have not yet affected China. The price is expensive, and it is also a US dollar, which the small company Huawei cannot afford at all.

In the mid-to-late 1990s, integrating into the global trend of advanced technology, C & C08 also developed an embedded real-time operating system based on the pSOS and VxWorks microkernels.

In the host system of the C & C08 128 module, the SPC module uses pSOS, and the PPC and CPC modules use VxWorks.

Wind River Corporation of the United States, which has the VxWorks core, also acquired pSOS and finally merged into Intel. Huawei’s main processor has long used Intel’s x86 architecture.

Nokia and Ericsson have adopted a similar approach, both of which are VxWorks customers.

Cisco is based on the QNX kernel and is QNX’s largest customer outside the automotive field. Dai is in Ottawa today, and QNX’s headquarters is here. QNX was established in 1980. A group of people have been humming for decades, constantly adapting to various scenarios, with excellent real-time stability and compatibility. QNX has a very high market share in the OS of traditional cars, reaching about 80%. QNX was later sold to BlackBerry, the once brilliant mobile phone brand.

The basic theoretical research of Huawei 5G was also led by Dr. Tong Wen, the chief scientist of Huawei 5G, in Ottawa.

?

Picture note: Veteran Dai Hui in front of Huawei Ottawa Research Institute

Since 2007, Huawei has successfully implemented a real-time operating system based on an open-source embedded Linux kernel.

This is a big step forward for the Linux camp and Huawei.

In fact, Wind River itself is promoting embedded Linux cores.

Yao Yiyu, chief architect of the core network platform, wrote an article called "Getting Up from the Mud Pit".

In 2007, the core network switched from the cPCI platform to the ATCA platform in the softswitch hardware architecture, but still used Intel’s x86 CPU. The biggest change was in the operating system, starting from the ATCA architecture, a lot of optimization was carried out on the embedded Linux to develop the embedded real-time operating system, and replace the previous embedded real-time operating system based on pSOS and VxWorks kernel.

Optimize the time delay of the Linux, bit by bit, and finally successfully reduce the delay to a very low level. Last time I heard drone company talk about development experience, it is also necessary to reduce the weight of the body one gram by one.

This is a great victory, and finally successfully created the first company-level telecom Linux operating system, which was later extended to the VRP of the data communication product line. Not only did it save money, but it also greatly improved its capabilities. Huawei has also made great historical contributions to the international embedded Linux open source camp.

According to Ren Zhengfei’s philosophy, if the core of a technology is algorithms and logic, Huawei can do it through hard work, so Huawei does battery management BMS (the core is algorithms and logic) in the car BU, but not batteries (the core is chemistry and materials). Ren Zhengfei strongly called on the country to train more mathematicians.

4,Introduced a new layer: cloud computing, a new architecture called NFV (Network Functions Virtualization). The original RTOS remains unchanged.

This is in the same vein as Huawei’s Fusion Sphere cloud computing operating system, which adopts various technologies such as KVM virtualization engine (also belonging to the Linux camp), Docker container, K8S (Kubernetes), etc.

Cloud technology brings opportunities for CPU switching and the introduction of ARM servers in the core network, which will be discussed later.

?Chapter 6: The Birth of Hongmeng RTOS

As you can see, Huawei’s OS has undergone independent development, RTOS development based on pSOS and VxWorks microkernel, and macro kernel development based on open source embedded Linux, which has laid a strong technical foundation and understanding for the birth of Hongmeng.

There is a person who is very crucial, his name is Wang Chenglu. He was first the president of the core network product line, and he accumulated experience on the core network OS (realized RTOS based on embedded Linux). Then he was transferred to the president of the central software department of the 2012 laboratory, and started Hongmeng’s research. There is a conversation between Ren Zhengfei and the staff of the 2012 laboratory on the Internet in 2012, indicating that Huawei developed the mobile operating system to be a "spare tire". The question was asked by Li Jinxi from the end point OS development department of the Euler Laboratory of the Central Software Institute under the 2012 laboratory, responsible for building the end point operating system capability for consumer BG.

Wang Chenglu ended up as president of software at Consumer BG. His article "The Past of Huawei’s Mobile Operating System" mentioned that Huawei’s optimized F2FS file system has overcome the traditional fragmentation of Android and has been absorbed by Google’s Android system. "Born fast, life fast". File systems are an important part of mobile and PC operating systems.

Notes: At the developer conference on August 9, Wang Chenglu released EMUI 10

Mr. Ren Zhengfei has an incisive quote about the Hongmeng operating system: We have thousands of (note: types) circuit boards, and all circuit boards must have an operating system. Hongmeng operating system is an operating system for determining the delay system. The end-to-end processing delay of the system is accurate to 5 milliseconds, or even lower milliseconds or even sub-milliseconds, and the control is only this hour delay, which is useful for the automatic production of the Internet of Things. For example, unmanned driving, the delay of gear turning is a few milliseconds. If it is inaccurate, otherwise this gear has come, and that gear has not come, it will not be able to bite. We are an operating system for the interconnection of all things and the future of intelligent society.

From Mr. Ren Zhengfei’s words, it can be seen that Hongmeng may also be used in system equipment in the future.

???Chapter 7: Huawei Operating System Group Fangpu

On the basis of the OS of the core network, Huawei’s operating system has blossomed, linking all three major BGs (operators, enterprises, consumers including mobile phones) and two major BUs (cloud computing, automobiles) of Huawei’s business.

In the group portrait of the Chinese operating system I described last year, Huawei’s serialized operating system has been listed, and the supplementary summary is as follows:

1. Router and data communication switching operating system: VRP (universal routing platform), which is another main line of Huawei OS

In 1996, Huawei’s C & C08 was selling well, and Huawei had food in its warehouse. It began research and development of data communication at the Beijing Research Institute.

Huawei’s VRP should be based on Wind River’s VxWorks microkernel to develop a real-time operating system. Tornado is a real-time operating system (RTOS) development environment launched by Wind River, similar to Microsoft Visual C, but provides richer debugging, simulation environment and tools. There is also a peer pSOS, which was later acquired by Wind River.

On January 23, 2003, Cisco accused Huawei of infringement in the United States. During the litigation process, it was found that Huawei’s VRP system was much smaller and more efficient than Cisco’s IOS.

Coincidentally, Cisco’s IOS is actually a real-time operating system based on the QNX kernel.

A few years ago, the core network OS used the open source embedded Linux core to achieve RTOS, Huawei data communication VRP has also adopted embedded Linux core.

In mobile communication, there is a very important field: PS domain (packet switching system), such as GGSN/SGSN, etc., the function is to handle IP data packaging and switching in 3G/4G/5G systems. Now everyone uses mobile phones basically to travel traffic instead of making calls, so the PS domain is getting bigger and bigger. PS is closely related to RAN (radio access network, base station, etc.), so Huawei has directly classified PS in the wireless product line (RAN) for many years.

Huawei’s 3G/4G/5G PS domain is based on its own data communication switch, so it has also used VxWorks’ microkernel.

In August 2018, the UK’s security review of Huawei’s system concluded that the VxWorks system adopted by Huawei would not be able to obtain security patches and upgrades after 2020, posing a security risk.

But in reality, this is not a problem.

On the one hand, Huawei’s data communication switch has developed its own RTOS based on embedded Linux kernel. Even for Wind River, the official website also introduces the success story of BT’s RAN (radio access network) using Wind River’s embedded Linux. On the other hand, Hongmeng’s microkernel can also be used as a spare tire.

2. Cloud computing operating system: Fusion Sphere.Initially using the XEN virtualization engine, it is now moving towards KVM.

3. Server operating systemWhat is it?EulerOS,It is about to open source and make progress together with the world.

4. IoT embedded operating system: LiteOS.Super lightweight, already open-source.

"AIoT is the development direction of IoT, and IoT needs AI to enhance its value. 5G is a bridge connecting AI and IoT. Its high bandwidth, high reliability, low latency and large connection open up a wider application field of AIoT."

5. Automotive and driverless operating systems: Hongmeng.Yu Chengdong announced that Hongmeng Open Source is the best way to absorb global wisdom through open source.

6. Smartphone, TV operating system: Hongmeng.This has been talked about a lot.

7. Ark Compiler.The Ark compiler is not the operating system itself, but on the one hand, it can improve the running efficiency of the compiled operating system program (mobile phones run faster), and on the other hand, it greatly facilitates the transfer of APP business to Hongmeng. The original Android application (APP) can be compiled through the Ark compiler and run on Hongmeng with only minor changes.

A flower alone is not spring. Huawei has cultivated many talents for the society for 30 years, and there are also many operating systems in the entrepreneurship department.

A. UCloud founded by Ji Xinhua is the only public cloud that has grown independently without relying on a big industry background. It became an instant hit because of the "Legend of Dota" mobile game cloud business. UCloud is the first in the public cloud to be developed based on the open-source KVM engine, even before Alibaba Cloud.

B. H3C was separated from the Huawei system. The VRP operating system has since "bloomed two flowers, one branch for each watch". The OS of the H3C system is named Comvare.

C, Univision was separated from Huasan, and Imos Inside is the trademark of Univision Security OS. Intel argued that Imos Inside infringed the trademark of Intel Inside, but failed to obtain the court’s support.

D. Jinghua Kexun founded by Zeng Haowen is the first independent desktop cloud OS in China, the first to adopt the KVM virtualization technology route, and successfully entered the army, army and air force.

????Chapter 8: If you master the operating system, you won’t be afraid of the CPU getting stuck

On May 15, Huawei was added to the Entity List, and Intel’s CPU supply to Huawei was temporarily cut off.

Veteran Dai Hui boldly predicted that this would not have a big impact on Huawei. Because after Huawei controls the operating system, the lower CPU can be flexibly switched.

In the field of data center (and cloud) servers, Intel holds more than 95% of the market share.

Due to historical reasons (the history has been introduced in this article), the current global telecom core network uses Intel’s x86 architecture general-purpose servers.

Because the telecom core network operating system is controlled by Huawei, and the upper-level business and ecosystem are also controlled by Huawei, servers in this field can be completely converted from the x86 architecture to the Arm architecture.

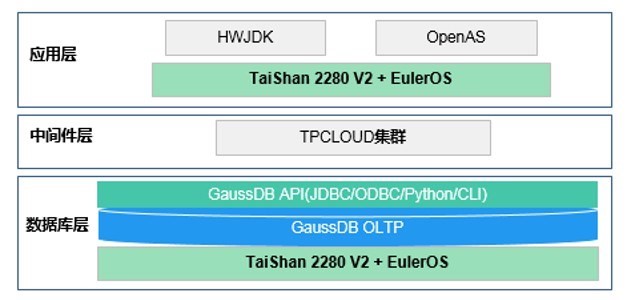

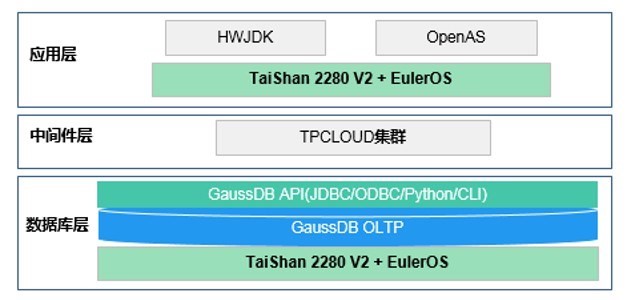

Huawei had to do this. On January 7 this year, Huawei released the first ARM architecture server CPU Kunpeng chip and Taishan server, and the publisher was Xu Wenwei. Through container technology, multiple Taishan servers (using Arm CPUs) can be formed into a large server cluster for use in the telecom core network.

Looking back Linux, the earliest version was only based on x86, and later it also supported various CPU architectures such as Arm, Power, and MIPS across platforms.

We will look at Tencent. WeChat’s server clusters are basically running Android and IOS ecosystems. Technically, Arm server clusters can also be used instead of the previous x86 server clusters.

In the field of telecom billing, Huawei has already had success stories.

In the early morning of July 19, 2019, after a tense and orderly cut-off, the software and hardware of Shandong Mobile’s billing CRM system were successfully replaced and upgraded, becoming the first operator to adopt a complete set of domestic self-developed software and hardware solutions in the core system, taking a solid step on the road of autonomy and control. Huawei’s self-developed series of IT software and hardware: TaiShan Taishan server based on Kunpeng 920, GaussDB Gaussian database, server operating system EulerOS.

Earlier, at the end of 2017, Academician Ni Guangnan disclosed that the Aerospace Science and Industry Group’s "secret network" was the largest national software and hardware information system at that time. It had deployed 20,000 national desktop computers, provided Cloud as a Service by domestic servers including "Aerospace Kunlun Database All-in-One Computer", and introduced a secure mobile phone using the Aerospace Yuanxin mobile operating system to support mobile office.

For personal computers, Intel also faces the challenge of Arm. Last summer, in the Microsoft store in Silicon Valley, I saw Qualcomm’s Arm-based CPUs, plus Microsoft Windows, and Lenovo Lenevo-built laptops that support always on. HiSilicon has also recently started to make CPUs based on the Arm architecture for laptops, looking forward to it.

?Conclusion: Innovation never ends

At the graduation ceremony of Southeast University in 2019, Xu Wenwei, who forged Huawei’s first chip and first OS, made a speech:

"What Huawei has been insisting on since its establishment is innovation. Over the past 30 years, Huawei’s success has been based on technological innovation and engineering innovation based on customer needs, solution innovation to help customers succeed, and commercial success. We call this innovation Huawei Innovation 1.0. With the rapid development of the information industry for more than 50 years, both theory and engineering have encountered development bottlenecks. We need theoretical breakthroughs, and we need innovation from 0 to 1.

"Huawei has officially announced its entry into Innovation 2.0. The core of Innovation 2.0 is theoretical breakthroughs based on vision and the invention of basic technologies. One of the sources of theoretical breakthroughs and basic technological inventions is academia.