1. What is the significance of the Interim Measures of Beijing Municipality for the Management of Designated Medical Security in Medical Institutions to strengthen the management of designated medical institutions?

The Interim Measures for the Fixed-point Management of Medical Security of Medical Institutions in Beijing clearly stipulates that eligible medical institutions can be included in the fixed-point management of medical insurance by applying for signing a medical insurance agreement, and clarifies the basic conditions and procedures for signing the agreement. The power and responsibility relationship between medical insurance administrative departments, medical insurance agencies and designated medical institutions is clear. Medical insurance agencies and medical institutions are the main body of the agreement, and the medical insurance administrative department supervises the processes of fixed-point application, professional evaluation, agreement conclusion, agreement performance and termination.

It is clear that designated medical institutions provide services according to the agreement, implement the relevant policies and regulations of medical insurance, submit information to medical insurance agencies as required, and serve the insured. At the same time, they should cooperate with medical insurance agencies to carry out medical insurance cost audit and performance appraisal.

It is clear that medical insurance agencies provide handling services in accordance with the agreement, and carry out cost audit and performance appraisal. Defining the liability of the subject of the agreement for breach of contract, and putting forward the specific circumstances of the suspension and dissolution of the agreement are conducive to promoting the standardization of medical service behavior, ensuring the safety of medical insurance funds, and promoting the standardization and legalization of designated management of medical institutions.

2. What are the conditions for medical institutions to apply for inclusion in medical insurance designated points in the Interim Measures for the Administration of Medical Insurance Designated Points of Medical Institutions in Beijing?

Medical institutions need to meet the basic conditions when applying to be included in the designated medical insurance, including the operating time of the institution shall not be less than 3 months, and the personnel with certain business license qualifications and services. In addition, five requirements are put forward in the application conditions: first, the requirements of medical insurance management system, including the corresponding medical insurance management personnel. The second is the requirements of medical insurance financial system. Truly record the "purchase, sale and storage" of drugs and consumables in the medical insurance catalogue. The third is the requirement of medical insurance statistical information, and the relevant information and data of medical insurance settlement are submitted as required. Fourth, the medical insurance information system requires providing direct online settlement for the insured. The establishment of medical insurance drugs, diagnosis and treatment projects, medical service facilities, medical consumables, diseases and other basic databases, according to the provisions of the use of national unified medical insurance code. Fifth, the catalogue of medical insurance drugs, consumables and medical services requires the use of basic medical insurance drugs, consumables and medical services to control the proportion of patients’ own expenses and improve the efficiency of the use of medical insurance funds.

3. What is the positive impact of the Interim Measures for the Management of Designated Medical Security in Beijing Medical Institutions on expanding the coverage of designated medical insurance and facilitating people’s medical treatment?

The starting point of the Interim Measures for the Designated Management of Medical Security in Medical Institutions in Beijing is to meet the health needs of the people, and the purpose is to strengthen and standardize the designated management of medical institutions and medical security, improve the efficiency of the use of medical security funds, and better protect the rights and interests of the majority of insured persons. Medical insurance agencies and qualified medical institutions, negotiation, reach an agreement, the two sides voluntarily signed a service agreement. By simplifying the application conditions, optimizing the evaluation process and improving the negotiation mechanism, it is helpful to expand the supply of medical resources and provide more suitable and high-quality medical services for the masses.

Iv. Interim Measures of Beijing Municipality on the Fixed-point Management of Medical Insurance in Medical Institutions Under what circumstances, the medical insurance agency has the right to suspend or terminate the medical insurance agreement?

The Interim Measures for the Management of Designated Medical Security in Medical Institutions in Beijing clarifies that medical insurance agencies or the third-party agencies entrusted by them carry out performance appraisal on designated medical institutions, and strengthen post-event supervision of designated medical institutions. The situation of termination and dissolution of the agreement is clearly defined.

The suspension of the designated medical insurance agreement refers to the suspension of the agreement between the medical insurance agency and the designated medical institution. The termination of the agreement mainly includes four situations: first, according to the daily inspection and performance appraisal, it is found that the security of the medical insurance fund and the rights and interests of the insured may cause significant risks; Second, failing to provide relevant data to medical insurance agencies and medical security administrative departments according to regulations or providing untrue data; Third, according to the agreement, standstill agreement should be; Fourth, other circumstances that should be suspended as stipulated by laws, regulations and rules. The medical insurance expenses incurred during the suspension period will not be settled. If the suspension period ends and the validity period of the agreement does not exceed, the agreement can continue to be performed; If the validity period of the agreement expires, the agreement shall be terminated.

The termination of the designated medical insurance agreement refers to the termination of the medical insurance agreement between the medical insurance agency and the designated medical institution, the agreement relationship no longer exists, and the medical expenses generated after the termination of the agreement are no longer settled. The Interim Measures for the Fixed-point Management of Medical Security in Medical Institutions in Beijing put forward 14 kinds of situations to terminate the agreement, mainly focusing on the implementation of medical insurance agreement, strengthening medical insurance management, ensuring the safety of medical insurance funds, practicing according to law and standardizing medical service behavior. For example, the medical insurance agreement has been suspended for two or more times within the validity period of the medical insurance agreement, or it has not been rectified as required or the rectification is not in place during the suspension of the medical insurance agreement; To resort to deceit and other improper means to apply for a fixed point; It is verified by the medical security department and other relevant departments that there is fraudulent insurance fraud; Providing medical insurance fee settlement for non-designated medical institutions or medical institutions during the suspension of medical insurance agreements; Refusing, obstructing or not cooperating with the medical security department to carry out intelligent audit, performance appraisal, supervision and inspection, etc., and the circumstances are bad.

5. What are the supervision of designated medical institutions by the Interim Measures of Beijing Municipality for the Management of Designated Medical Security of Medical Institutions?

The administrative department of medical security shall supervise the performance of the agreement, the use of medical security funds, the behavior of medical services, and the purchase of third-party services involving the use of medical security funds in designated medical institutions through on-site inspections, spot checks, intelligent monitoring and big data analysis. Supervise the fixed-point application, application acceptance, professional evaluation, agreement conclusion, agreement performance and cancellation. The medical security management department broadens the supervision channels and innovates the supervision methods, conducts social supervision on designated medical institutions through various ways, unblocks the channels for reporting and complaining, and promptly handles the problems found.

When the agency finds that the designated medical institution is in breach of contract, it shall deal with it in a timely manner according to the agreement, suspend the medical services used by the relevant responsible personnel or departments involved in the medical insurance fund, and suspend and terminate the medical insurance agreement. When the administrative department of medical security finds that there is a breach of contract in a designated medical institution, it shall order the agency to handle it according to the medical insurance agreement.

Six, the implementation date of the Interim Measures for the designated management of medical security in medical institutions in Beijing?

The Interim Measures for the Designated Management of Medical Security in Beijing Medical Institutions will be implemented on January 1, 2022.

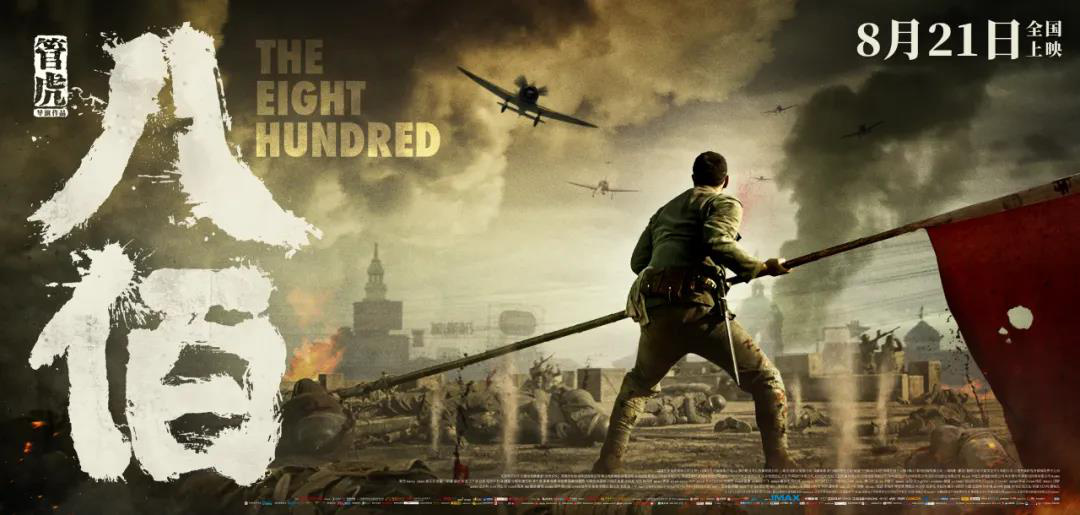

Director Guan Hu

Director Guan Hu