A-share major index samples will usher in regular sample adjustment.

On the evening of November 24th,Shanghai stock exchangeIt is said that the institute and China Securities Index Co., Ltd. decided to, SSE 180,, Science and Technology 50 and other indexes, which will take effect on December 11, 2023.(that is, it will take effect after the market closes on December 8, 2023).

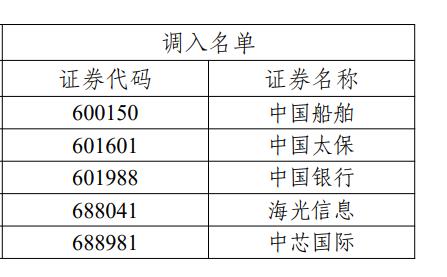

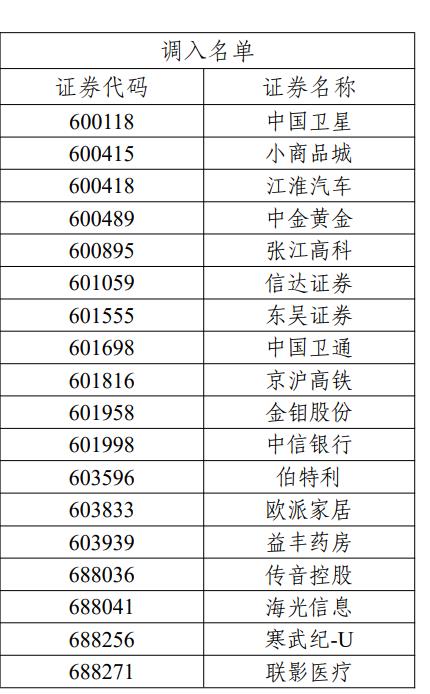

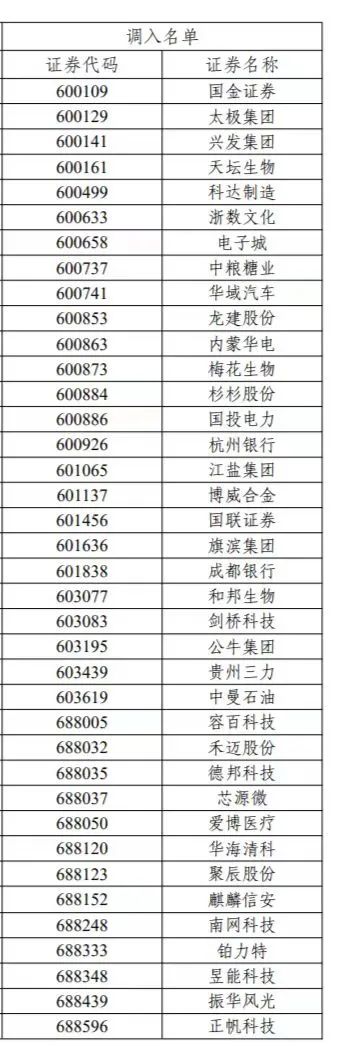

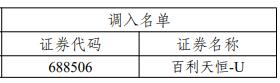

Among them,SSE 50 Index Replaced 5 Samples, transfer in、、、、Five;The SSE 180 Index replaced 18 samples., transfer in、Wait;Index replacement of 38 samples13 science and technology innovation board were transferred;Kechuang 50 index replaced 1 sample., transfer in.

Source: Shanghai Stock Exchange website

The results of sample adjustment will take effect on December 11th.

Overall, this sample adjustment will take effect on December 11th, 2023 (that is, it will take effect after the market closes on December 8th, 2023). Among them, the SSE 50 index changed 5 samples and transferred 5 securities.

Source: Shanghai Stock Exchange

18 samples of SSE 180 Index were replaced and transferred to other securities.

Source: Shanghai Stock Exchange

The index changed 38 samples and transferred 13 science and technology innovation board securities.

Source: Shanghai Stock Exchange

Kechuang 50 index is transferred.

Source: Shanghai Stock Exchange

After sample adjustment, the index representativeness is further enhanced.

China securities journal reporter noted that after the adjustment, the Shanghai Stock Exchange 50 Index’s super-large panlongtou characteristics and the Shanghai Stock Exchange 180 Index’s basic disk and ballast stone characteristics were further strengthened, and the number of information technology and industrial industry samples in line with the national key strategic direction increased. The market value representation of Kechuang 50 is further enhanced, which better represents the performance of large and medium-sized securities in science and technology innovation board.

Among them, the total market value of the SSE 50 index sample is 16.5 trillion yuan, accounting for 35% of the Shanghai stock market, which is 2 percentage points higher than that before the sample adjustment, and it will be returned to the mother in the first three quarters of 2023.1.6 trillion yuan, accounting for 46% of the Shanghai stock market, 5.5 percentage points higher than before sample adjustment, and the median total market value of index samples exceeded 170 billion yuan, which significantly improved the representation of leading companies in Shanghai stock market; The proportion of the real economy industry has further increased, and the samples of information technology and industrial industries have increased by one each, with the weights increasing by 1.1% and 0.5%.

The total market value of the SSE 180 Index sample was 25.9 trillion yuan, accounting for 54.6% of the Shanghai stock market, up 1.4 percentage points from before the sample adjustment. In the first three quarters of 2023, the sample company realized a net profit of 2.8 trillion yuan, accounting for 79.7% of the Shanghai stock market, up 0.5 percentage points from before the sample adjustment. The median total market value of the index sample exceeds 70 billion yuan, and 111 sample companies are state-controlled listed companies, with a total weight of over 70%, ranking first among major domestic scale indexes; The proportion of the real economy industry has further increased, and the samples of information technology and industrial industry have increased by 3 and 1 respectively, with the weight increasing by 0.7% and 1.2%.

The total market value of the samples of the Science and Technology 50 Index was 2.4 trillion yuan, accounting for 37.4% of the total in science and technology innovation board, up 0.2 percentage points from that before sample adjustment. From the perspective of industry distribution, the Science and Technology Innovation 50 Index is still based on a new generation of information technology,、And other industries, with weights of 68.2%, 9.7% and 6.7% respectively.

Isometric samples are also adjusted regularly.

On the evening of 24th, CSI Index Co., Ltd. also announced that it would adjust the CSI 300,, CSI 1000 and other index samples, this adjustment is a regular routine adjustment of index samples, and the regular adjustment plan will also take effect on December 11, 2023.

According to the index rules, the Shanghai and Shenzhen 300 Index replaced 14 samples,Equal transfer-in index; Index to replace 50 samples,、Equal transfer-in index; The CSI 1000 Index replaced 100 samples,、Equal transfer-in index.

It is reported that after this sample adjustment, the main index samples are more focused on the transformation and upgrading of the real economy and scientific and technological innovation, information technology, industry,The number of samples in other industries has increased, and the representativeness of the index has been further enhanced.

Among them, the number of information technology industry samples in the Shanghai and Shenzhen 300 Index increased by 3, and the weight increased by 0.25%; The number of industry samples increased by 1 net, and the weight increased by 0.35%. The number of industrial samples in the index increased by 8, and the weight increased by 1.01%. In the CSI 1000 Index, the number of samples in the information technology industry increased by 10, and the weight increased by 0.74%. The CSI 300, CSI 500 and CSI 1000 indexes are full of scientific and technological innovation vitality. After adjustment, the samples of science and technology innovation board and GEM are 50, 106 and 320 respectively, with weights of 14.24%, 11.11% and 31.69% respectively.

According to CSI Index Co., Ltd., after the sample adjustment, from the perspective of market value coverage, the Shanghai and Shenzhen 300, CSI 500 and CSI 1000 indexes account for 50.10%, 15.57% and 14.92% of the total market value of the Shanghai and Shenzhen markets respectively. Sample of Shanghai and Shenzhen 300 Index in the first three quarters of 2023It accounts for 59.93% of the Shanghai and Shenzhen markets, and its net profit accounts for 78.46% of the Shanghai and Shenzhen markets; In the first three quarters of 2023, the operating income of the CSI 500 index sample accounted for 15.83% of the Shanghai and Shenzhen markets, and the net profit accounted for 10.38% of the Shanghai and Shenzhen markets. The median total market value of the CSI 1000 index sample is 10.8 billion yuan, and the small-cap characteristics are prominent. Judging from the valuation, according to the closing price on November 22nd, the adjusted rolling P/E ratios of CSI 300, CSI 500 and CSI 1000 are 10.93 times, 16.86 times and 21.85 times respectively.