In order to further promote the high-quality development of China’s banking industry and give full play to the advantages of the association’s service functions and public and professional platforms, the China Banking Association has published the "Top 100 Banking Companies in China" for four consecutive years. This list follows the principles of simplicity, objectivity and professionalism, refers to the Basel Accord and the relevant requirements of the regulatory authorities on the capital strength of the banking industry, takes the net core tier-one capital as the only evaluation standard, and comprehensively evaluates the operation scale, profitability, operational efficiency and asset quality of the top 100 banks in China, trying to become an important reference for measuring the comprehensive strength of China’s banking industry and an important window for all sectors of society to understand the current situation and development trend of China’s banking industry.

The net core tier 1 capital is the deduction of core tier 1 capital, which mainly covers paid-in capital or common stock, capital reserve, surplus reserve, general risk reserve, undistributed profit, minority shareholders’ capital, etc. Core Tier 1 capital has the strongest ability to absorb losses, which is an important indicator of the bank’s risk compensation ability and an important foundation for the bank’s operation and development. The list selects the core Tier 1 net as the ranking basis, and adds data such as asset size, net profit, cost-income ratio and non-performing loan ratio as reference, which has full theoretical and practical significance. In this fight against the epidemic, sufficient capital has provided a solid foundation for banking financial institutions to support epidemic prevention and control and help economic development.

This list strives to achieve the following three goals:First, the data is authoritative and fair.By giving play to the role of industry self-regulatory organizations, it provides information and data reference for the market. The data mainly comes from the consolidated report data at the end of the previous year in the public annual reports of banks.Second, the index design is objective and professional.The design of the index system not only conforms to international norms and facilitates international exchanges and comparisons, but also fully combines the national conditions of China and presents it in RMB, which can intuitively reflect the actual situation of local banks.Third, it covers a wide range.All Chinese-funded commercial banks are included in the same list, regardless of the traditional classification such as state-owned banks, national joint-stock banks, city commercial banks and rural commercial banks. The 100 banks on the list account for 96.87% of the total assets of commercial banks and create 96.08% of the net profit of commercial banks.

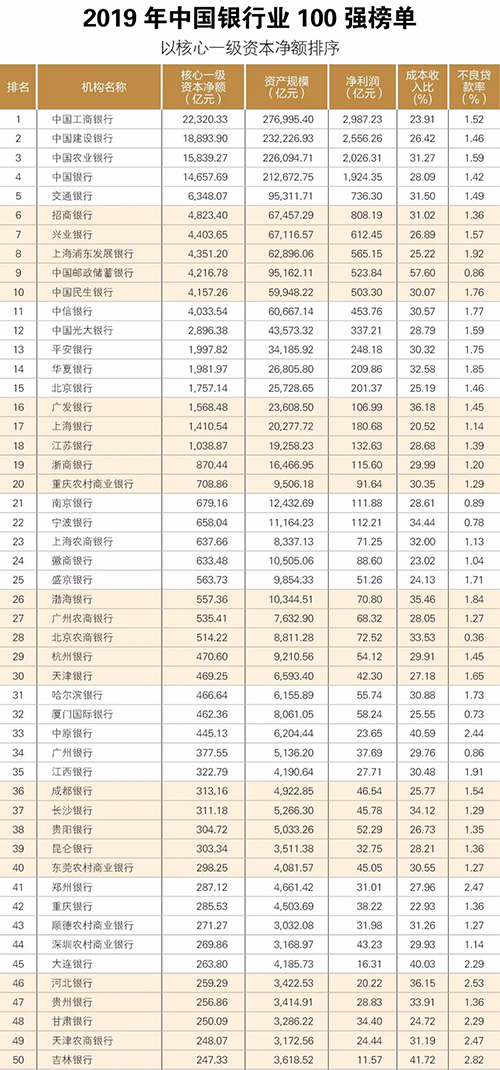

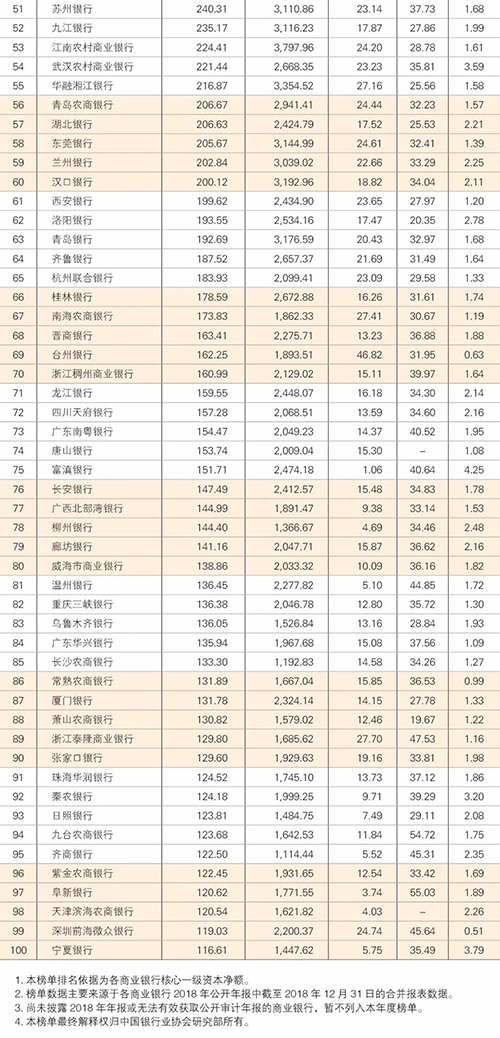

At the end of 2018, the net core Tier 1 capital of listed banks totaled 13,823,894 million yuan, with a year-on-year growth rate of 10.94%, an increase of 0.54% compared with 2017. In 2019, the top 100 commercial banks included 6 large state-owned banks, 11 national joint-stock commercial banks, 63 city commercial banks, 19 rural commercial banks and 1 private bank.

Among the top 10 banks with net core tier 1 capital, China Industrial and Commercial Bank, China Construction Bank, China Agricultural Bank, China Bank and Bank of Communications continue to occupy the top five, China Merchants Bank and Industrial Bank rank sixth and seventh respectively, and Shanghai Pudong Development Bank, China Postal Savings Bank and China Minsheng Bank rank eighth and tenth. Among the top 20 banks with net core tier 1 capital, Bank of Beijing, Bank of Shanghai and Bank of Jiangsu are the top three city commercial banks, ranking 15th, 17th and 18th respectively, and Chongqing Rural Commercial Bank, as the number one rural commercial bank, ranks among the top 20 for the first time.

In terms of the ranking of core Tier 1 net capital, Gansu Bank rose 19 places, Weihai Commercial Bank rose 18 places, Jiangxi Bank rose 15 places, Taizhou Bank and Guangxi Beibu Gulf Bank rose 13 places, Guangzhou Bank, Changsha Bank and Hubei Bank rose 12 places, Jiujiang Bank rose 10 places, and Wuhan Rural Commercial Bank, Qingdao Rural Commercial Bank and Nanhai Rural Commercial Bank all rose 9 places. It is worth mentioning that three city commercial banks, Liuzhou Bank, Zhejiang Tailong Commercial Bank and Zhuhai China Resources Bank, and two rural commercial banks, Changshu Rural Commercial Bank and Zijin Rural Commercial Bank, were all shortlisted for the first time. Shenzhen Qianhai Weizhong Bank, as one of the earliest private banks, took the lead in entering the top 100 list, ranking 99th.

Judging from the growth rate of core tier 1 net capital, large banks such as China Agricultural Bank, China Construction Bank and China Postal Savings Bank all achieved double-digit growth, accounting for 18.21%, 11.71% and 10.48% respectively. The net growth rate of core Tier 1 capital of joint-stock banks Guangfa Bank and Huaxia Bank exceeded 30%, accounting for 39.93% and 33.15% respectively. The growth rates of Guangzhou Bank and Gansu Bank, city commercial banks, exceeded 50%, accounting for 59.46% and 50.96% respectively. The net growth rate of core Tier 1 capital of rural commercial banks Wuhan Rural Commercial Bank, Shanghai Rural Commercial Bank, Nanhai Rural Commercial Bank and Qingdao Rural Commercial Bank also exceeded 20%.

The internal capital replenishment of listed banks still faces some pressure. By the end of 2018, 100 listed banks had achieved a total net profit of 1,758.416 billion yuan, a year-on-year increase of 4.05% and a decrease of 1.23 percentage points compared with 2017. The total assets of listed banks were 197.04 trillion yuan, up 5.12% year-on-year, down 2.28 percentage points from 2017. Although the growth rate of assets of commercial banks has slowed down in recent two years, the growth rate of net profit of commercial banks is still lower than that of total assets, which means that the ability of banks to supplement core capital through profit retention is limited, which intensifies the pressure of capital replenishment of commercial banks. Since 2019, due to the complicated economic environment, market environment and regulatory environment, the capital replenishment situation of commercial banks in China still faces many challenges. Commercial banks should enrich the capital replenishment toolbox, improve the efficiency of capital use, promote the light transformation of business development, and achieve high-quality development.